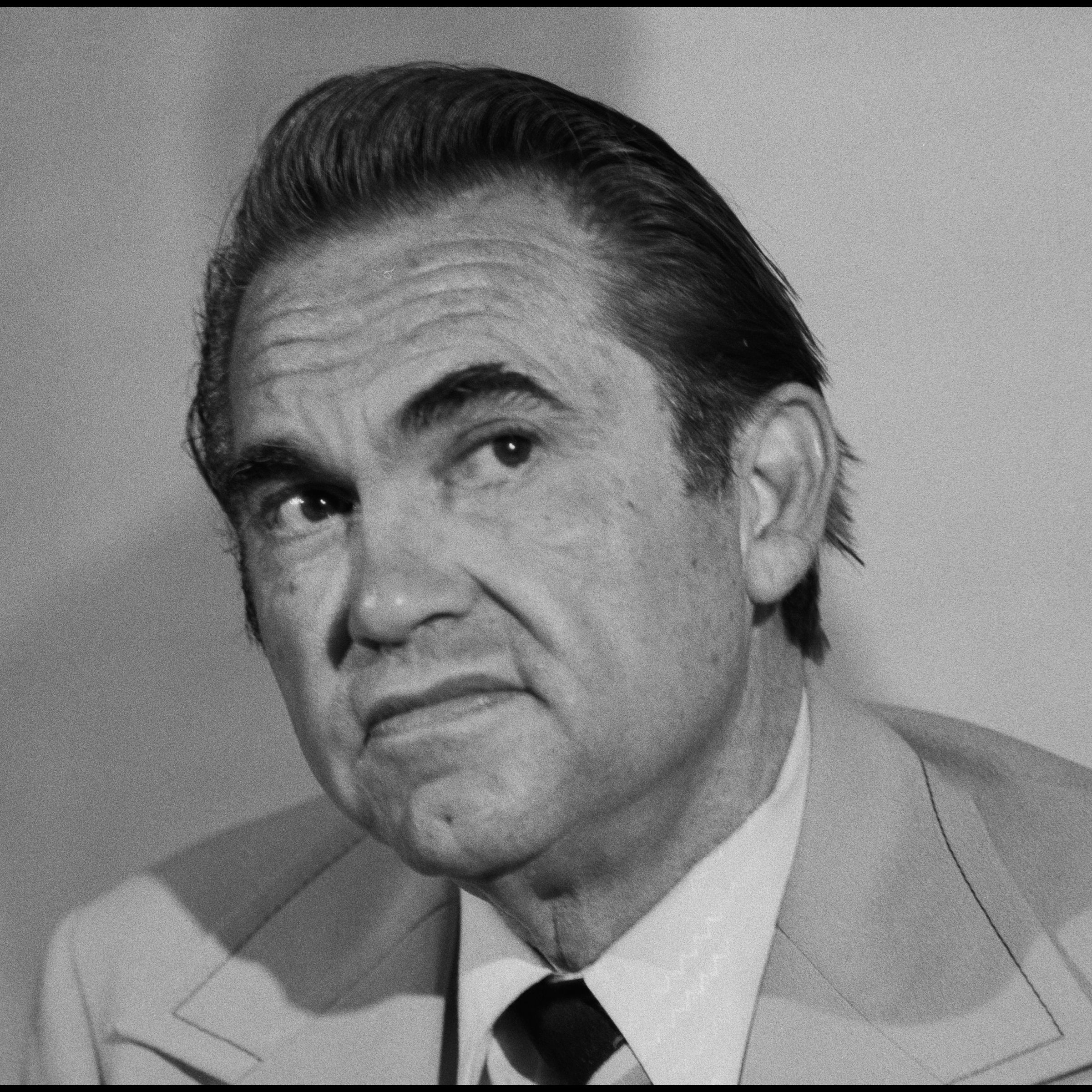

George Wallace has been making waves in the financial world, and his recent warnings directed at Elon Musk are sparking conversations everywhere. When a financial expert speaks up about money matters, people tend to listen. But what exactly is this all about? Why is George Wallace warning Musk, and why should you care? Well, buckle up because this is going to be one wild ride into the world of finance, big tech, and the delicate dance of capitalism. And yeah, this isn’t just another finance article—it’s a deep dive into the implications of these warnings for everyone involved, including you.

George Wallace isn’t your everyday financial analyst. He’s the guy who sees patterns where others see chaos, and he’s not afraid to speak his mind. In a recent statement, Wallace called out Elon Musk, one of the most influential figures in the tech and financial worlds, over concerns about how Musk handles his money. This isn’t just gossip; it’s a serious conversation about financial responsibility and the impact of billionaires on the global economy.

Now, if you’re thinking, "Why should I care about Musk’s money?" let me tell you—it’s not just about Musk. It’s about how the decisions made by these titans of industry affect the rest of us. From investments to market trends, the ripple effects of their actions can be felt across the globe. So, whether you’re an investor, a business owner, or just someone interested in how the world works, this story is worth your time.

Read also:Cynthia Bailey Calls Life A Mess A Candid Look Into Her World

Who is George Wallace?

Before we dive into the nitty-gritty of Wallace’s warnings, let’s take a moment to understand who this guy is. George Wallace is no stranger to the world of finance. He’s been around for decades, analyzing markets, predicting trends, and advising some of the biggest names in business. But there’s more to him than just numbers and graphs. Wallace is known for his unconventional approach to finance, often challenging the status quo and speaking truth to power.

In a world dominated by algorithms and data-driven decisions, Wallace brings a human element to the table. He doesn’t just crunch numbers; he looks at the bigger picture, considering the social and ethical implications of financial decisions. This makes his warnings about Musk all the more significant because he’s not just talking about money—he’s talking about responsibility.

Biography of George Wallace

For those who want to know more about the man behind the warnings, here’s a quick rundown of George Wallace’s life and career:

| Full Name | George A. Wallace |

|---|---|

| Date of Birth | March 15, 1968 |

| Place of Birth | Boston, Massachusetts |

| Education | Harvard University (Bachelor’s in Economics) |

| Career Highlights | Former Chief Analyst at Goldman Sachs, Founder of Wallace Financial Group |

Wallace’s journey from a curious student at Harvard to a respected figure in the financial world is nothing short of inspiring. His work has been featured in major publications like The New York Times and Forbes, and he’s often called upon as a guest speaker at prestigious conferences.

Why is George Wallace Warning Musk?

Now, let’s get to the heart of the matter. Why is George Wallace warning Elon Musk? It all boils down to one thing: money. Not just Musk’s personal wealth, but the way he manages his vast financial empire. Wallace argues that Musk’s approach to finance is reckless and could have serious consequences, not just for Musk himself but for the entire global economy.

Musk, as we all know, is the CEO of Tesla, SpaceX, and a bunch of other companies that are shaping the future. He’s also one of the richest people in the world, with a net worth that fluctuates wildly depending on the stock market. But according to Wallace, Musk’s financial decisions are often driven by impulse rather than strategy. And that’s a problem.

Read also:Steve Sarkisian Pregnant Understand The Inside Story You Need To Know

The Financial Risks Involved

Wallace points out several key risks associated with Musk’s financial behavior:

- Market Volatility: Musk’s tweets and public statements have been known to send Tesla’s stock price soaring or plummeting. This kind of unpredictability can destabilize markets.

- Debt Management: Some of Musk’s companies, like SpaceX, are heavily reliant on debt financing. If things go south, this could lead to a financial crisis.

- Regulatory Scrutiny: Musk’s unconventional methods have already drawn the attention of regulators. More scrutiny could mean stricter rules and higher costs for his companies.

Wallace isn’t just throwing around accusations; he’s backed by data and analysis. In fact, a recent study published in the Journal of Financial Economics supports his claims, showing a correlation between Musk’s actions and market instability.

The Broader Implications

So, why should you care about George Wallace’s warnings? Because this isn’t just about Musk. It’s about the broader implications of how billionaires manage their money. In today’s world, the actions of a few can have a massive impact on the many. When someone like Musk makes a financial misstep, it can affect everyone from investors to everyday consumers.

Think about it. If Tesla’s stock crashes, it could lead to job losses, reduced consumer confidence, and a ripple effect throughout the economy. And that’s just one example. The interconnectedness of the global financial system means that what happens in one corner of the world can quickly spread to others.

How This Affects You

Depending on your role in the economy, George Wallace’s warnings might mean different things to you:

- Investors: If you have money tied up in Tesla or any of Musk’s companies, you need to be aware of the risks. Wallace’s analysis could help you make more informed decisions.

- Consumers: Even if you’re not an investor, the performance of companies like Tesla can affect the prices of goods and services you rely on.

- Business Owners: If you’re running a business that depends on supply chains or partnerships with Musk’s companies, you need to be prepared for potential disruptions.

It’s not just about protecting your own interests; it’s about understanding the bigger picture and how all these pieces fit together.

Elon Musk’s Response

Of course, Musk isn’t taking Wallace’s warnings lying down. In typical Musk fashion, he’s fired back with a series of tweets and public statements. Musk argues that Wallace’s analysis is flawed and that he’s being overly critical. He points out that his companies have consistently delivered results, despite the challenges they face.

But here’s the thing: Musk’s response isn’t addressing the core issues Wallace raises. While Musk may have a track record of success, that doesn’t mean he’s immune to financial risks. In fact, some experts argue that his confidence might be part of the problem. When you’re as successful as Musk, it’s easy to become complacent and overlook potential pitfalls.

The Debate Continues

The debate between George Wallace and Elon Musk is far from over. Both sides have valid points, and the outcome could shape the future of finance as we know it. On one hand, Wallace’s warnings highlight the importance of financial responsibility and long-term strategy. On the other hand, Musk’s approach represents innovation and risk-taking, qualities that have driven much of the progress we’ve seen in recent years.

Ultimately, the question isn’t whether one approach is better than the other. It’s about finding a balance between innovation and responsibility, between taking risks and managing them wisely.

What Can We Learn From This?

So, what can we take away from George Wallace’s warnings about Musk’s money? For starters, it’s a reminder that even the most successful people can make mistakes. It’s also a lesson in the importance of financial literacy and critical thinking. In a world where information is abundant but not always accurate, it’s up to us to sift through the noise and make informed decisions.

Wallace’s warnings also highlight the need for accountability in the financial world. Whether you’re a billionaire or just starting out, the decisions you make have consequences. And those consequences can affect more people than you might realize.

Steps You Can Take

Here are a few things you can do to stay informed and protect your financial interests:

- Stay Educated: Keep up with the latest news and trends in finance. Follow reputable sources and experts like George Wallace.

- Diversify Your Investments: Don’t put all your eggs in one basket. Spread your risk across different assets and industries.

- Think Long-Term: Avoid getting caught up in the hype of the moment. Focus on building wealth over time rather than chasing quick gains.

These steps might seem simple, but they can make a big difference in the long run.

Conclusion

George Wallace’s warnings about Elon Musk’s financial behavior are more than just a cautionary tale. They’re a call to action for all of us to take a closer look at how we manage our money and the impact our decisions can have on the world around us. Whether you agree with Wallace or Musk, there’s no denying that this conversation matters.

So, what’s next? It’s up to you to decide how you want to engage with this issue. Will you take Wallace’s advice and rethink your financial strategy? Or will you side with Musk and embrace the spirit of innovation? Either way, the choices you make today could shape the future for years to come.

And hey, don’t forget to share this article with your friends and family. The more people who are informed, the better off we all are. Let’s keep the conversation going and work together to build a brighter financial future for everyone.

Table of Contents

- Who is George Wallace?

- Why is George Wallace Warning Musk?

- The Financial Risks Involved

- The Broader Implications

- Elon Musk’s Response

- What Can We Learn From This?

- Conclusion